A dispute over $15,000 may reshape the American tax code and probably halt $340 billion in authorities income.

On Dec. 5, the Supreme Court docket heard oral arguments in Moore v. United States, a case that facilities on the obligatory repatriation tax (MRT) included in 2017’s Tax Cuts and Jobs Act. The considered a $14,729 tax invoice would possibly fill some taxpayers with horror, however advocates say the result of this listening to may have a much more pricey affect on each tax guidelines already in place and people being thought-about by President Joe Biden’s administration.

Don’t miss

Right here’s why this case is so pivotal.

Reshaping the tax code

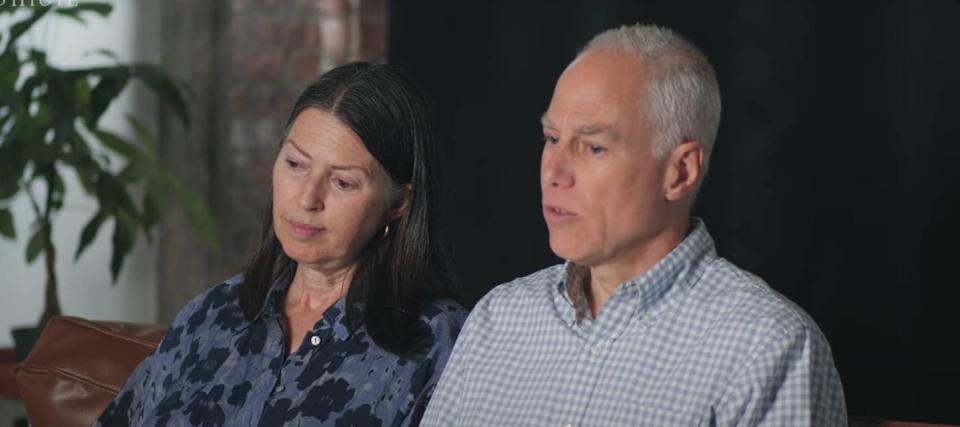

Charles and Kathleen Moore of Redmond, Washington State, are the plaintiffs on this case. In 2005, the couple invested $40,000 to purchase a 13% stake in KisanKraft, a producing enterprise primarily based in India. Nevertheless, when Congress handed President Donald Trump’s signature Tax Cuts and Jobs Act (TCJA), it positioned a levy on U.S. taxpayers who owned greater than 10% of a international firm.

The federal government expected the rule to generate practically $340 billion in tax income over 10 years.

Based mostly on this new rule, the Moores paid $14,729 in taxes, regardless of telling American Enterprise Institute, a center-right thinktank, that they hadn’t acquired a penny from the enterprise at that time. They’re now in search of a refund, arguing that the tax is “unconstitutional” and “an unapportioned direct tax in violation of the Structure’s apportionment necessities.” In easy phrases, the couple believes the federal government has no proper to tax unrealized beneficial properties.

A “achieve isn’t earnings until and till it has been realized by the taxpayer,” lawyer Andrew Grossman reportedly instructed the Supreme Court docket justices throughout the listening to.

If the Supreme Court docket guidelines of their favor, it may open the door to reshaping the nation’s tax code. Stan Veuger, Alex Brill and Kyle Pomerleau, senior fellows on the American Enterprise Institute (AEI), fear that if the Moores win, it “dangers upending key parts of the present federal earnings tax and wreaking havoc on components of the U.S. financial system.”

Considered one of their high considerations is {that a} requirement that earnings be realized earlier than it may be taxed may result in elevated “financial distortions, create coverage uncertainty and scale back federal income.” Calling it “economically incoherent,” the AEI fellows add a call in favor of the Moores may result in the reintroduction of issues earlier laws sought to deal with, and thus elevated wealth disparity as the rich maintain on to property strategically and look to search out alternatives to purchases or gross sales that enable them to keep away from paying tax altogether.

Different consultants additionally fear in regards to the affect on authorities income. Tax Coverage Heart Institute Fellow Eric Toder estimates that the federal authorities may lose $87 billion in income for 2024 and $125 billion by 2028 if the courtroom guidelines within the couple’s favor. To cowl the shortfall, Congress might need to implement new guidelines. If the shortfall isn’t coated, it may additional increase the federal government’s funds deficit.

In the meantime, Democrats are fearful the case may affect their potential to implement a wealth tax.

Learn extra: Due to Jeff Bezos, now you can use $100 to cash in on prime real estate — with out the headache of being a landlord. Here is how

Undermining the wealth tax

In late November, lawmakers introduced the Billionaires Earnings Tax Act — a brand new rule they are saying may shut loopholes and drive rich people to pay their justifiable share in taxes.

The invoice would tax any particular person with greater than $1 billion in property — or $100 million in earnings for 3 consecutive years — at a 20% fee. This may apply to each realized earnings and unrealized beneficial properties.

Democrat Sen. Ron Wyden, who’s championing the Billionaires Earnings Tax Act, argues that the invoice might be stymied if the Moores win their case. This may put a key component of the Biden administration’s tax agenda in danger.

Based mostly on their feedback, it appears that some Supreme Court docket justices are leaning in direction of a slim ruling to keep away from far-reaching impacts throughout the tax code and financial system. Nevertheless, a call isn’t anticipated till 2024.

What to learn subsequent

This text gives info solely and shouldn’t be construed as recommendation. It’s supplied with out guarantee of any form.

Now Local weather Change on the Newsmaac