Simply 46% of Individuals aged 55 and over have a will or different property planning doc, in line with senior dwelling referral service Caring.com. However even the presence of 1 doesn’t imply all issues are avoidable.

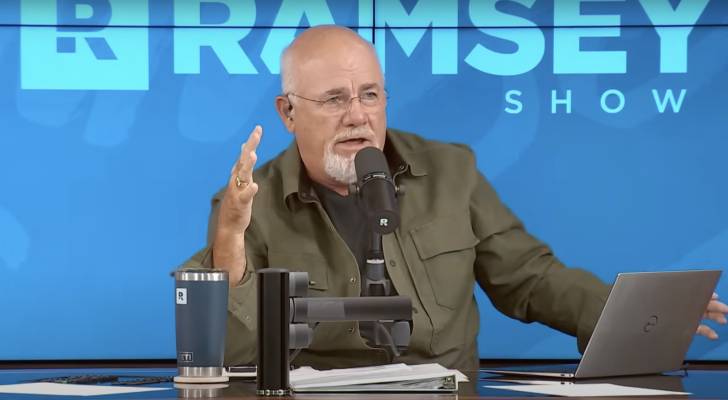

A current caller on the The Ramsey Present, Sheryl from Medford, Oregon, said her mom handed away just lately, leaving a belief for her farm. However although the siblings (Sheryl, her sister and brother) have been to divide the property equally, the following scenario has led to household discord.

Don’t miss

“They need to have their butts kicked in for not doing this correctly,” Ramsey responded. Right here’s why the scenario upset him.

The scenario

Sheryl is in her late 60s and fortunately married. When her mom handed, she left behind an property Sheryl claims is value $2.2 million. The farm property is held in a belief, in line with which the property are to be cut up evenly between Sherly, her brother and sister.

Nonetheless, Sheryl’s siblings have invested within the property, including some buildings over time. And that’s created disagreement a couple of truthful cut up. “How is that [equal split] truthful in the event that they put cash into it and also you didn’t?” Ramsey requested her.

He stated he believes the siblings and mom ought to have outlined particular phrases about how the property could be divided, given the truth that some have contributed greater than others. “Let me let you know, the entire concept that they’d construct a constructing on another person’s property with out having all the things lined out within the belief intimately was fairly silly as a result of it units up an enormous argument,” he contended.

An absence of property planning is pervasive. As of 2023, solely 34% of all Americans had a will, in line with Caring.com’s 2023 Wills and Property Planning Research. About 40% of the rest with out a will stated {that a} medical analysis would encourage them to make an property plan, however roughly one in 4 stated “nothing would inspire” them to take action.

Sheryl’s scenario highlights how even having a will and belief fund can nonetheless result in disputes between members of the family. Ramsey steered a number of options.

Learn extra: Due to Jeff Bezos, now you can cash in on prime real estate — with out the headache of being a landlord. Here is how

The answer

Ramsey believes the trustee (Sheryl’s brother) is legally mandated to comply with the belief phrases and cut up the property evenly. Nonetheless, trusts are complicated constructions and the extent of flexibility a trustee has is dependent upon the belief’s phrases and state legal guidelines.

Nonetheless, Ramsey believes the siblings may come to a mutual settlement on a cut up that they’d settle for as fairer. As an example, they may separate the truthful worth of the properties constructed by the siblings over time after which cut up the leftover worth equally.

Ramsey stated this is able to be the “moral” answer.

All adults ought to have a will

Then there may be the overall query of who ought to write a will. “if you happen to’re 18 years previous or older you want a will, interval!” Ramsey stated. “It is what grown-ups do, and by the way in which, the federal government’s going to finish up with a bunch of this, too, if you happen to do not.”

Relying on the dimensions of the property, beneficiaries may owe property taxes on a state or federal degree. A proper plan may doubtlessly decrease this tax legal responsibility.

You can too decrease legal responsibility and confusion by updating the desire everytime there’s a serious life occasion. Sheryl’s household, in line with Ramsey, ought to have revised the belief when the siblings invested within the property with new additions.

In truth, the Ramsey group and his household get collectively yearly for a gathering titled “If Dave Dies This 12 months.”

“We sit and speak about my demise for an hour and a half,” he stated, “[and about] what has modified since final 12 months within the operation of Ramsey.”

Ramsey’s internet value is estimated at $200 million with a reported $150 million in actual property, in line with TheStreet. Provided that type of nine-figure wealth, an annual succession planning session isn’t simply pertinent; it may show the perfect path to keep away from the type of infighting Sheryl’s household has handled since shedding their mom.

What to learn subsequent

This text supplies data solely and shouldn’t be construed as recommendation. It’s offered with out guarantee of any variety.

At the moment Information Prime Newsmaac