Once you’re “the other way up” or “underwater” on an auto mortgage, it means you owe greater than the car is price. This case is nearly inevitable, per Debt.org, contemplating how autos lose worth.

However David from Oklahoma just lately instructed Dave Ramsey that he and his spouse are the other way up on 4 autos concurrently — a truck, an SUV and two bikes — they usually need to downsize and get debt free.

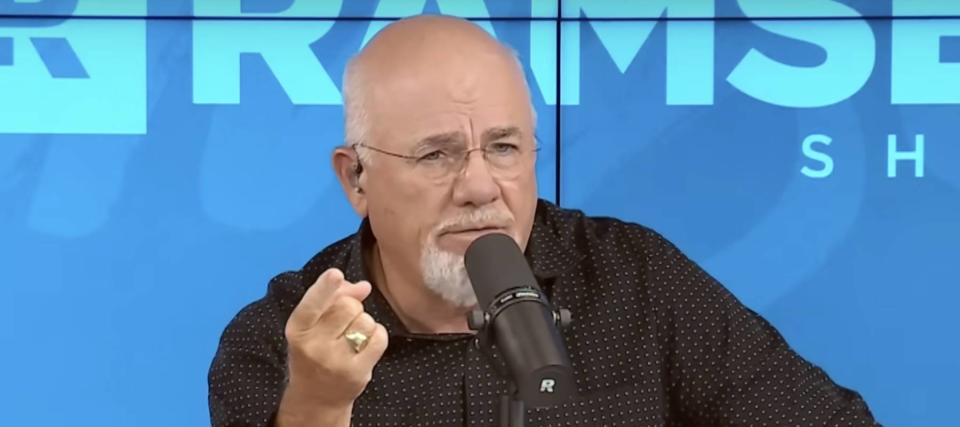

The couple’s funds on these loans are so excessive, Ramsey stated it made him “need to puke” on a recent episode of “The Ramsey Present.” He stated, “Don’t inform me you’ve a tractor. I’ll kill ya.”

Don’t miss

Whereas David didn’t provide specifics on how far the other way up these loans are, it seems promoting is not going to be sufficient. Automobile homeowners may nonetheless owe hundreds of {dollars} in a lump sum in the event that they promote their autos privately or give up them to the financial institution. Voluntary repossession must be prevented so far as doable, stated Ramsey.

Making issues worse for the couple is the decline in used-car costs. “… since a peak in early 2022, used-car values have fallen greater than 20%, in response to the Manheim Used Automobile Worth Index,” Bloomberg reported in December.

The monetary knowledgeable listed 3 ways they may take motion.

Stack money, cowl the distinction

One of many methods to cope with an underwater asset, in response to Ramsey, is to “stack money and canopy the distinction.” Basically, chopping again on bills and boosting earnings ought to assist David and his spouse accumulate sufficient capital to shut the hole between their auto loans and the market worth of their autos.

Sadly, David just lately misplaced his job, making it troublesome to implement this technique immediately. In the meantime, the debt burden is immense. David and his spouse should pay $852 a month for his truck, $677 for her SUV, and $555 and $408 respectively for 2 bikes. Altogether, the couple wants roughly $2,500 a month to cowl these funds however at the moment reside on a single wage and unemployment advantages.

“I do know you misplaced your job however proper now just isn’t the time to attend in your dream job to return alongside,” stated co-host Jade Warshaw. “Proper now get any jobs you’ll be able to.” Ramsey needed him to think about trip sharing or meals supply. “You’ll be able to drive since you’ve acquired a variety of issues to drive,” he stated dryly.

Learn extra: Due to Jeff Bezos, now you can cash in on prime real estate — with out the headache of being a landlord. Here is how

Borrow the distinction

David may additionally borrow funds to cowl the distinction between market worth and buy value. Ramsey inspired him to hunt out a mortgage from a credit score union or different lenders. He can then use the cash together with the proceeds of promoting the autos privately to repay the auto loans in full.

Debt consolidation like it is a frequent technique, in response to TD Bank. Debtors normally faucet into their house fairness or apply for private loans to repay debt that’s both too costly or due imminently (though using home equity carries its own risks).

This technique additionally hinges on the borrower’s creditworthiness and earnings, thus David’s present unemployment may complicate this technique.

Negotiate with the lender in particular person

Ramsey’s remaining suggestion is to barter with the auto lender straight. David’s auto mortgage is likely to be held at an area financial institution or credit score union the place the supervisor is keen to think about another: an unsecured be aware for the distinction between the mortgage quantity and the resale worth of those autos.

It’s important, Ramsey instructed David, that this be executed “in particular person, not on the telephone and for God sakes not by e mail! Go sit down and look ‘em within the eye.” Restructuring or refinancing debt is troublesome however definitely doable.

Massive companies – together with automobile gross sales retailers, paradoxically – restructure debt regularly. Used-car firm Carvana (CVNA) efficiently restructured $1.3 billion in debt earlier this 12 months to keep away from chapter. Particular person debtors ought to contemplate such negotiations too.

One other different: yard sale

Primarily based on the idea {that a} household with 4 autos in all probability has extra property, Warshaw inspired David to promote different possessions to lift money. “One thing tells me with these vans and autos, you’ve acquired extra stuff laying round to do away with,” she stated.

Train gear, lawnmowers, furnishings or something with scrap worth might be bought off to assist rescue the household from this pressing state of affairs and provides them some respiration room.

What to learn subsequent

This text offers info solely and shouldn’t be construed as recommendation. It’s offered with out guarantee of any form.

Now Local weather Change on the Newsmaac