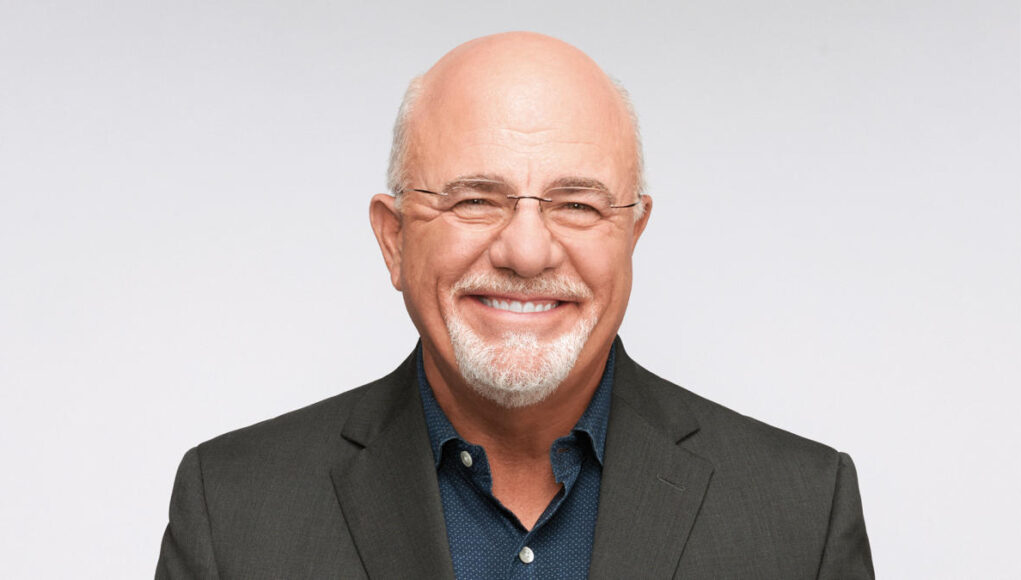

It’s protected to say that monetary guru Dave Ramsey isn’t any fan of Social Safety, having referred to as this system a “silly factor” and “mathematical catastrophe” that “robbed” him of his cash for many years. It needs to be no shock, then, that Ramsey goes against conventional wisdom in the case of the age you should claim Social Security benefits.

Social Safety: Not Everyone Gets the Full 3.2% COLA Increase — Here’s Why

See: Pocket an Extra $400 a Month With This Simple Hack

Ramsey says it’s nice to collect benefits as early as age 62 — one thing most monetary specialists advise in opposition to — in the event you take your checks and make investments them. He claims that doing so gives you a better return than you’ll get by ready till a later age to use for Social Safety, which implies you get a much bigger month-to-month test.

“It normally is smart to take it early in the event you’re going to … make investments each little bit of it,” Ramsey stated in a 2019 podcast that aired on YouTube.

Ramsey was responding to a query from a listener about whether or not it made extra sense to gather Social Safety at 62 or wait till full retirement age, which is both 66 or 67 years previous, relying in your beginning 12 months.

The best way Social Safety is about up, the longer you wait to collect retirement benefits, the upper your month-to-month cost. Claiming advantages at age 62 means you’ll get the smallest potential test. Your test rises annually previous age 62 you wait to gather.

If you hit full retirement age you get the total advantages due primarily based on the Social Safety payroll taxes you contributed whereas working. The very best cost comes while you file at age 70, after which there isn’t a extra monetary benefit to ready.

Ready till you might be 70 years previous to say Social Safety might boost your finances by more than $182,000, in line with a current examine performed by David Altig of the Federal Reserve Financial institution of Atlanta, Laurence Kotlikoff of Boston College and Victor Yifan Ye, a analysis scientist at Opendoor Applied sciences.

Then again, in the event you determine to gather as quickly as you flip 62, you’ll obtain a significantly reduced (by 30%) benefit for the rest of your life vs. ready till full retirement age.

However in line with Ramsey, you’ll be able to greater than make up for these shortfalls by making use of for Social Safety at 62 after which placing all your checks right into a “good mutual fund.”

“That one account will make you greater than sufficient to cowl up the distinction between your [age] 66 account and your [age] 62 account,” Ramsey stated on the podcast earlier than going right into a mini-rant about Social Safety being a “damaged system” and a “catastrophe.”

He didn’t say what constitutes a “good mutual fund” or supply options on the best way to discover one. There’s not a whole lot of data monitoring common mutual fund performances over time, primarily as a result of there are such a lot of several types of funds, and their performances are all around the map

A 2020 weblog on the Credit score Donkey website reported that buyers earned a median of 4.67% on mutual funds in the course of the earlier 20 years. That was effectively under the S&P 500 index efficiency over the identical timeframe. Over the previous 30 years, the S&P 500 index has delivered a compound common annual development price of 10.7% per 12 months, The Motley Idiot not too long ago reported.

However discovering a “good” mutual fund is perhaps tough for Social Safety recipients who usually are not monetary specialists and may’t afford to rent one.

Social Safety: New Proposal for Higher COLA Bump for Certain Federal Retirees – Would You Qualify?

One other factor Ramsey didn’t handle was the truth that many Social Safety recipients depend on their checks to help pay the bills, they usually don’t have the monetary wherewithal to place them right into a mutual fund within the hope that the fund will present return years down the highway.

Extra From GOBankingRates

This text initially appeared on GOBankingRates.com: Dave Ramsey: Take Social Security at Age 62, but Only If You Do This With Each Check

Now Local weather Change on the Newsmaac