For many retirees, their month-to-month Social Safety earnings is indispensable. Primarily based on greater than 20 years of annual surveys from nationwide pollster Gallup, no fewer than 80% of retired respondents have relied on their Social Safety test, in some capability, to make ends meet in a given yr.

Given how necessary Social Security is to the monetary well-being of our nation’s growing old workforce, you’d suppose sustaining a robust basis could be a prime precedence. Nonetheless, America’s prime retirement program is going through a long-term funding shortfall that continues to widen with nearly each passing yr.

Social Safety is staring down a $22.4 trillion money shortfall

For greater than eight a long time, the Social Safety Board of Trustees has launched an annual report detailing the monetary well being of America’s main retirement program. This report additionally takes under consideration a myriad of demographic modifications, in addition to fiscal and financial coverage shifts, to forecast Social Safety’s solvency 10 years (the “brief time period”) and 75 years (the “long run”) into the long run.

The excellent news is that Social Safety is in no danger of going bankrupt or becoming insolvent by the point you retire. Roughly 90% of the income collected by Social Safety derives from the 12.4% payroll tax on earned earnings (wages and salaries, however not funding earnings). So long as People proceed to work and pay their taxes, the Social Safety Administration (SSA) can have money to disburse advantages to those that are eligible.

What will not be sustainable is the present payout schedule, together with cost-of-living changes. Primarily based on estimates from the 2023 Trustees Report, the Previous-Age and Survivors Insurance coverage (OASI) Belief Fund may exhaust its asset reserves by 2033. Ought to this happen, sweeping profit cuts of as much as 23% could also be obligatory for retired staff and survivors of deceased staff.

On a broader scale, the Trustees estimate Social Safety is staring down a $22.4 trillion funding shortfall via 2097. If this shortfall is not rectified, sweeping profit cuts could be the expectation.

Did lawmakers steal from Social Safety and create this funding drawback?

There isn’t a scarcity of theories as to why Social Safety is going through a rising money shortfall. However one of many extra well-liked viewpoints on-line is that America’s prime retirement program has been accomplished in by its personal lawmakers. Particularly, there’s the idea that Congress pilfered Social Safety’s belief funds (the OASI and Incapacity Insurance coverage (DI) Belief Fund), which has weakened the monetary well being of this system.

Whereas it is a fairly well-liked on-line thesis — for those who do not consider me, be happy to test the remark part of any Social Safety article printed on-line — it lacks one key element: fact.

When the Social Safety Act was signed into legislation in 1935, it contained provisions that outlined what would occur to any extra income taken in by this system (i.e., any cash collected above and past what’s disbursed to eligible beneficiaries and used by way of administrative bills to run the Social Safety program). The legislation requires Social Safety’s asset reserves to be invested in interest-bearing particular subject bonds. This additionally consists of certificates of indebtedness.

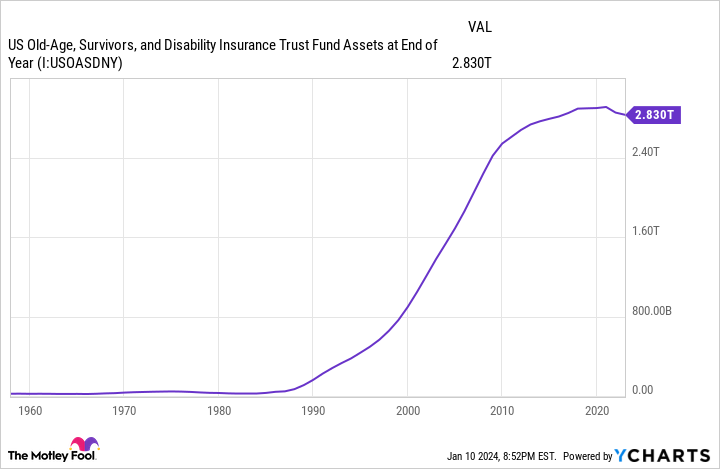

Put one other approach, Social Safety’s extra money is not gathering mud in a vault. As of the top of November 2023, the OASI and DI belief funds had a mixed $2.77 trillion in asset reserves invested in particular subject bonds and, to a far lesser extent, certificates of indebtedness. This $2.77 trillion, which is invested in a mess of bonds with numerous rates of interest and maturities, sports activities a median rate of interest of two.436%. The SSA publicly updates the OASI and DI funding holdings month-to-month, in addition to offers an in depth breakdown, based mostly on maturities, yearly within the Trustees Report.

Each single cent of Social Safety’s asset reserves is accounted for by way of special-issue bonds and certificates of indebtedness. Bear in mind, these are debt securities backed by the total religion of the U.S. authorities.

Moreover, the curiosity earnings Social Safety is being paid by the U.S. authorities is one among its three funding sources. Placing apart the truth that investing this system’s asset reserves in special-issue bonds is required by legislation, having extra reserves acquire mud in a vault would value an already cash-strapped retirement program an estimated $67 billion in annual curiosity earnings. In different phrases, Social Safety could be in significantly worse monetary form if its asset reserves weren’t invested in super-safe authorities bonds.

To sum it up, Congress hasn’t stolen a dime from Social Safety; each cent in asset reserves is accounted for; and this system is producing curiosity earnings on its extra money.

This is what’s actually incorrect with Social Safety

The $22.4 trillion greenback query is: If Congress hasn’t stolen from Social Safety, how did America’s prime retirement program get into this case?

The reply primarily lies with ongoing demographic shifts, together with some blame to lawmakers — albeit for a totally completely different purpose than described above.

Some demographic modifications are well-known, such because the regular retirement of child boomers. As extra boomers go away the workforce, there merely aren’t sufficient new staff getting into the labor pressure to maintain the worker-to-beneficiary ratio from declining.

Life expectancy has additionally grown by roughly 13 years for the reason that first Social Safety profit test was mailed out 84 years in the past. Social Safety was by no means meant to dole out funds to a majority of seniors for a number of a long time.

However it’s the much less seen demographic shifts which are actually taking a toll on Social Safety. As an example, authorized internet migration into the U.S. has been precipitously declining for 25 years. Immigrants coming to the U.S. are usually youthful, which implies they’re going to spend a long time within the labor pressure contributing to Social Safety by way of the payroll tax. A scarcity of authorized immigration is a giant drawback.

On the similar time, U.S. beginning charges have fallen to historic lows. {Couples} are ready longer to get married and have kids than ever earlier than. Moreover, financial elements, equivalent to rising house costs and short-term financial uncertainty, have inspired {couples} to carry off on having kids. Decrease beginning charges could be anticipated to adversely influence the worker-to-beneficiary ratio in generations to come back.

Rising earnings inequality is one other drawback for Social Safety. In 1984, 91% of all earned earnings was topic to Social Safety’s payroll tax. However as of 2021, solely 81% of earned earnings was uncovered to the payroll tax. In different phrases, a bigger share of earnings for prime earners is escaping the payroll tax over time.

Along with demographic shifts, lawmakers do deserve some blame. The shortcoming of Republicans and Democrats to discover a common-ground answer to strengthen Social Safety has made a future repair all of the harder.

There isn’t any query Social Safety has a difficult street forward. Nonetheless, beneficiaries do not need to concern themselves with the whereabouts of this system’s asset reserves.

The $21,756 Social Safety bonus most retirees fully overlook

In case you’re like most People, you are just a few years (or extra) behind in your retirement financial savings. However a handful of little-known “Social Safety secrets and techniques” may assist guarantee a lift in your retirement earnings. For instance: one simple trick may pay you as a lot as $21,756 extra… annually! When you discover ways to maximize your Social Safety advantages, we expect you possibly can retire confidently with the peace of thoughts we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Idiot has a disclosure policy.

Has Congress Really Stolen Trillions From Social Security? Here’s the Truth. was initially printed by The Motley Idiot

Now Local weather Change on the Newsmaac