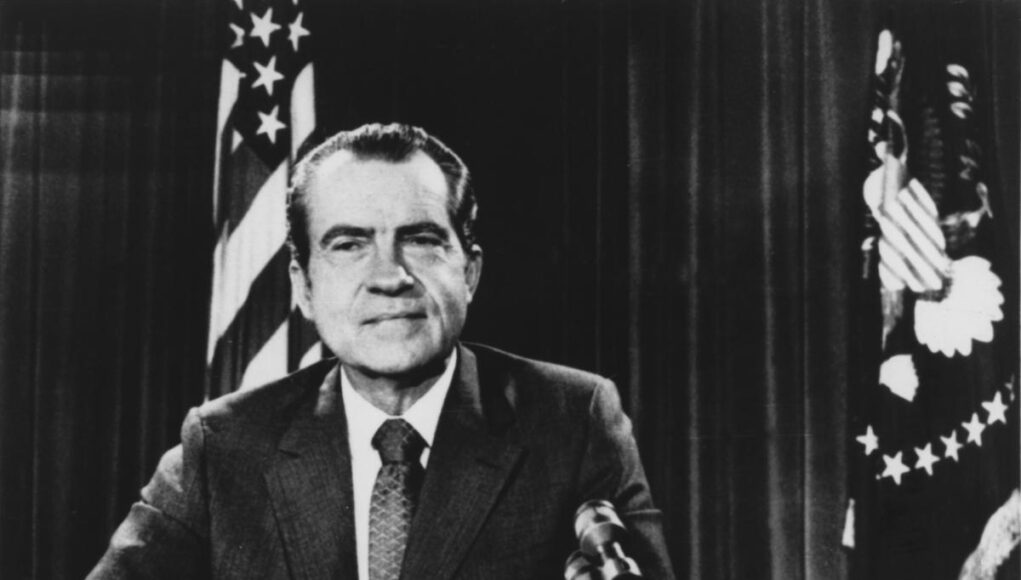

It was Aug. 15, 1971, and then-President Richard Nixon delivered an address to the nation to put out a brand new financial method for a rustic beset by financial worries and challenges to the US greenback.

A key prong of his plan was an “import surcharge” — in impact a brand new tariff — of 10% throughout America’s buying and selling relationships to prop up US enterprise within the face of what Nixon referred to as unfair trade charges.

“This import tax is a short lived motion, it is not directed in opposition to some other nation,” Nixon stated. “When the unfair therapy is ended, the import tax will finish as effectively.”

The measure was applied by govt order however was passed by the tip of that 12 months. The episode is instructive as former President Donald Trump campaigns round a strikingly similar idea for “common baseline tariffs” of 10% that may apply to most overseas merchandise coming into the US.

“I really like China, I really like all people, however they can not benefit from us,” Trump stated at a latest rally in New Hampshire.

The episode can be illustrative of the ties between Trump and Nixon that embrace a political allegiance that spans their many years of separation on the political stage. The 2 males socialized at least once and sometimes wrote to each other close to the tip of Nixon’s life.

As Todd Tucker of the Roosevelt Institute once noted on X: “Find it irresistible or hate it, like many Trump concepts, the thought of a ten p.c import surcharge comes from issues Nixon really did.”

The import surcharge as a ‘negotiating tactic’

The opposite planks of Nixon’s 1971 plan — new limits on the trade of {dollars} for gold and a 90-day freeze on wages and costs — turned landmarks in financial history.

Nixon’s strikes on foreign money ultimately ushered in a brand new period of floating trade charges and an finish of the so-called Bretton Woods worldwide financial system that had been in place since World Struggle II.

At this time, the import surcharge could also be much less remembered largely as a result of it wasn’t round lengthy sufficient to have a large financial influence. It was additionally gone after being “bitterly opposed by america’ buying and selling companions,” because the New York Instances noted at the time.

Nevertheless it seems to have served an vital function as a negotiating tactic.

Japan was a spotlight for Nixon on the time as his administration was attempting to strain the nation to barter a revaluation of the yen. Germany was additionally a precedence, says Richard Baldwin of the IMD Enterprise College.

“The US was mad on the Germans for preserving the worth of the Deutschmark low,” he defined in a latest interview.

Nixon’s import surcharge compelled each the Germans and Japanese to take one other take a look at their currencies. The import surcharge resulted in December 1971 as a part of the so-called Smithsonian Agreement amongst G-10 nations that included vital preliminary foreign money wins for the Nixon administration.

However Baldwin warns that there could also be fewer off-ramps on the subject of Trump’s method to a ten% tariff this time round, particularly together with his eager concentrate on China.

“There’s nothing that the Chinese language might do that may make us pleased with them,” he says, noting that the present rivalry is basically concerning the monetary buildings of two superpowers and the query of who would be the world’s financial engine over the approaching many years.

Trump can be eyeing far more aggressive measures geared toward China past something on the desk for Nixon. The present GOP hopeful has publicly discussed an effort to quickly decouple with China starting in 2025 and “part out all Chinese language imports of important items.” On Saturday, the Washington Post also reported that Trump is privately discussing the potential of imposing a flat 60% tariff on all Chinese language imports.

China has “gained competitiveness and that is what folks like Trump are all upset about and there isn’t any remedy to that,” Baldwin notes.

As he crisscrosses the nation for his present run, Trump usually guarantees he can “get issues solved” with China however presents little element on what that may appear like and the way lengthy a tariff, which might extract significant economic consequences if left in place for an prolonged interval, is perhaps wanted.

As a substitute the candidate whose historic wins this month in Iowa and New Hampshire seem to place him on the trail to a 3rd consecutive GOP nomination talks about his tariffs as ones that may very well be in place for the long run.

He has likened them to “a hoop across the collar” of the US, including a declare that they might be a bonanza for the US Treasury as companies are hit with the brand new duties. The Tax Basis lately pegged the proceeds of the ten% tariffs at $300 billion a 12 months.

A populist tactic

The 1971 episode with Nixon can be proof of the ability of the thought of a tariff to sway public opinion.

Future Federal Reserve Chair Paul Volcker — who in 1971 was the Treasury undersecretary for financial affairs — later recalled that the surcharge was regarded as two pronged: “each an important negotiating tactic and a option to entice public assist.”

The import surcharge push from Nixon was additionally seen as a option to head off extra protectionist impulses that have been percolating on the time on Capitol Hill.

Tucker of the Roosevelt Institute additionally famous the significance of the surcharge as a PR software, writing in a 2009 book with Lori Wallach that the surcharge did virtually nothing to vary the US buying and selling steadiness. “Nevertheless,” he wrote, “the underlying political objective had been achieved: Nixon had established his populist credentials” and boosted his ballot numbers.

This time round, Trump is the one pushing the dialog in a extra protectionist route over many in his personal occasion who is perhaps cautious of one other spherical of world tensions.

Trump usually touts his tariff plan as proof of how he’s the candidate seeking to defend Individuals at the same time as economic studies of the commerce wars he undertook throughout his time period in workplace counsel blended outcomes. His tariffs did certainly defend some US jobs however at the price of increased costs for everybody, in keeping with a few of the outcomes.

Nonetheless, as Trump declared at a latest rally, “We’ll impose stiff penalties.”

Ben Werschkul is Washington correspondent for Yahoo Finance.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance

At this time Information High Newsmaac