Over a number of a long time, Wall Road is a surefire wealth creator. When in comparison with the annualized returns of housing, gold, oil, and even bonds, the inventory market simply has these asset courses beat over lengthy intervals.

However issues get a bit dicey when the lens is narrowed and traders study the efficiency of the broader market over a few years or a couple of months. Since this decade started, the ageless Dow Jones Industrial Common (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-driven Nasdaq Composite (NASDAQINDEX: ^IXIC) have alternated between bear and bull markets in successive years. This volatility has traders questioning what’s subsequent for the inventory market.

There is no such factor as a foolproof predictive indicator or metric that may, with 100% accuracy, forecast directional strikes within the Dow Jones, S&P 500, and Nasdaq Composite. However there’s a choose group of datapoints which have exceptionally correct observe information of correlating with large strikes in shares.

One such metric that ought to have the complete consideration of Wall Road and traders in the mean time is U.S. money supply.

U.S. cash provide hasn’t performed this since 1933

Whereas there are a handful of cash provide measures, M1 and M2 are the 2 that economists are likely to concentrate on probably the most.

M1 cash provide encompasses money and cash in circulation, in addition to demand deposits in a checking account. Consider M1 as simply accessible cash that may be spent at a second’s discover. M2 accounts for every part in M1 and provides in financial savings accounts, cash market accounts, and certificates of deposit (CDs) beneath $100,000. It is cash individuals can nonetheless get to with relative ease, nevertheless it requires a bit extra work to be spent. It is this latter class that is elevating eyebrows and ringing alarm bells.

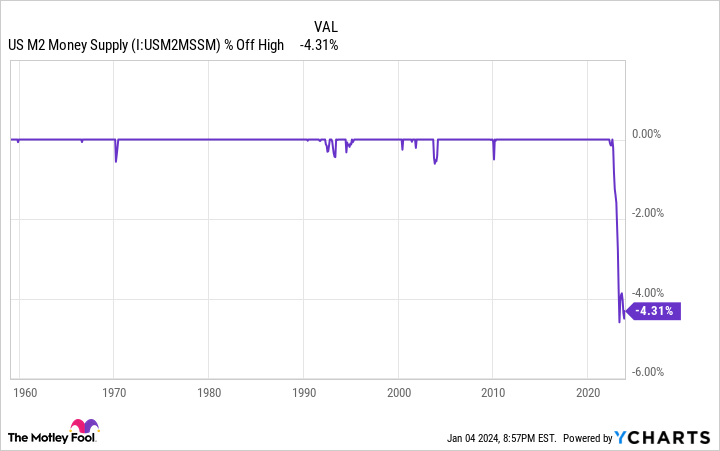

Traditionally talking, M2 has risen at a comparatively regular tempo for greater than 150 years. Because the U.S. financial system grows, extra capital is required to facilitate transactions. However in these uncommon situations the place M2 notably declines, hassle has adopted.

As you’ll be able to see from the chart above, M2 cash provide has dipped from a peak of $21.7 trillion in July 2022 to $20.77 trillion in November 2023. M2 is down a bit of over 2% on a year-over-year foundation and 4.31% from its all-time excessive set in mid-2022. It is the primary notable drop in M2 cash provide for the reason that Nice Despair.

Though it is a very modest decline in share phrases, it is a very large deal for an financial system that is been coping with a scorching-hot inflation fee. With the costs for items and companies collectively rising at a sooner tempo than the Federal Reserve’s long-term goal of two%, extra capital can be wanted to pay for issues. But when M2 is shrinking, it means individuals and companies should forgo sure purchases. That is usually a recipe for a recession.

The U.S. financial system hasn’t fared nicely when M2 has notably declined previously. Whereas there have been quite a few instances when M2 slipped fractionally when back-tested to 1870, there are solely 5 events over the previous 154 years the place M2 fell by 2% or extra on a year-over-year foundation: 1878, 1893, 1921, 1931-1933, and the fifth occasion is ongoing. The earlier 4 situations all resulted in deflationary depressions for the U.S. financial system, together with a large enhance within the unemployment fee.

WARNING: the Cash Provide is formally contracting. 📉

This has solely occurred 4 earlier instances in final 150 years.

Every time a Despair with double-digit unemployment charges adopted. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

To be truthful, issues have modified significantly with the U.S. financial system for the reason that late nineteenth and early twentieth centuries. The Federal Reserve did not exist through the melancholy in 1878 nor the Panic of 1893, and it has a wealth of information on how greatest to method downturns in comparison with the melancholy in 1921 and the Nice Despair. The prospect of a melancholy occurring as we speak is way decrease than it was 100 years in the past.

On the identical time, declines in M2 have traditionally been a harbinger of financial downturns. Roughly two-thirds of the S&P 500’s drawdowns for the reason that begin of the Nice Despair in September 1929 have occurred after, not previous to, a recession being declared. In different phrases, if the U.S. financial system shifts into reverse, a pullback or potential bear marketplace for shares could be the expectation.

M2 is not the one money-based metric sounding a warning

I want I may say that M2 cash provide is the one money-based metric that is at present sounding a warning for Wall Road — however this is not the case. Industrial financial institution credit score is one other probably worrisome money-focused datapoint.

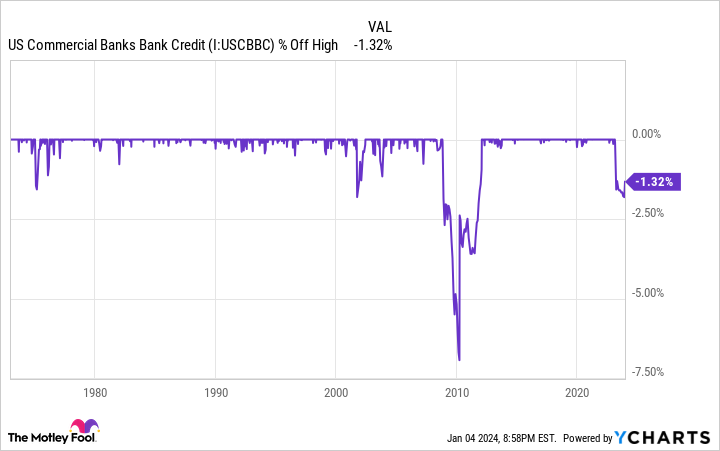

Like M2 cash provide, industrial financial institution credit score, which encompasses all loans, leases, and securities held by U.S industrial banks, has been trending larger with few exceptions for many years. Since information reporting started in January 1973, industrial financial institution credit score has elevated from $567 billion to $17.36 trillion, as of the week ended Dec. 20, 2023. This represents a roughly 7% compound annual development fee over a half-century.

This enhance is not shocking. Banks are incented to develop their mortgage and lease portfolios over time because the U.S. financial system expands. However when this regular uptrend in industrial financial institution credit score is interrupted, traders ought to pay shut consideration.

As proven within the chart above, there have been dozens of situations over the previous 50 years when industrial financial institution credit score endured minor (lower than 1.5%) declines. However there have solely been 3 times in 51 years when industrial financial institution credit score fell by greater than 2% from its all-time excessive:

-

A peak decline of two.09% on the peak of the dot-com bubble in October 2001.

-

A surprising 6.94% tumble following the Nice Recession in March 2010.

-

A (to this point) most decline of two.07%, as of November 2023.

What the newest drop in industrial financial institution credit score demonstrates is that monetary establishments have tightened their lending requirements, which is limiting entry to capital for some companies. It is akin to miserable the brake on a fast-moving car, and it will be anticipated to gradual company earnings development, or probably shift it into reverse.

The earlier two situations when industrial financial institution credit score fell by not less than 2% coincided with the benchmark S&P 500 dropping round half of its worth.

Historical past is a two-sided coin that strongly favors the affected person and optimistic

Based mostly on what some key money-based metrics inform us in the mean time, there is a chance 2024 could possibly be a difficult 12 months for traders. However investing is all about perspective, and historical past is a two-sided coin that very a lot favors these with an optimistic long-term method.

Whereas we would not like recessions, they are a completely regular and anticipated a part of the financial cycle. Since World Battle II led to September 1945, there have been 12 recessions in america. 9 of those 12 lasted mere months, whereas the remaining three did not surpass 18 months. Conversely, two expansions since World Battle II endured not less than a full decade.

This unevenness between financial expansions and contractions could be seen within the inventory market, as nicely.

Final 12 months, researchers at Bespoke Funding Group launched a dataset that examined the common size of bull and bear markets within the S&P 500 for the reason that begin of the Nice Despair. As proven within the put up above, the everyday bear market has lasted simply 286 calendar days, or 9.5 months. In the meantime, the common bull market sticks round for 3.5 instances as lengthy (1,011 calendar days).

What’s extra, there have been 13 S&P 500 bull markets over the past 94 years that endured longer than the lengthiest bear market. If that is not a ringing endorsement of optimism on Wall Road, I am undecided what’s.

Maybe the best instance of utilizing time as an ally comes from an yearly up to date dataset revealed by Crestmont Analysis. The analysts at Crestmont examined the rolling 20-year whole returns, together with dividends paid, of the S&P 500, courting again to 1900. Though the S&P did not exist till 1923, its parts could possibly be present in different main indexes previous to its creation, which allowed researchers to precisely back-test whole returns to 1900.

Out of the 104 rolling 20-year intervals (1919-2022) Crestmont Analysis examined, 100% of them yielded a constructive whole return. Put one other manner, it does not matter when traders put their cash to work in an S&P 500 monitoring fund, so long as they (hypothetically) held their positions for 20 years. No matter what 2024 has in retailer for Wall Road, time is traders’ best ally.

10 shares we like higher than Walmart

When our analyst workforce has an investing tip, it may possibly pay to hear. In spite of everything, the publication they’ve run for over a decade, Motley Idiot Inventory Advisor, has tripled the market.*

They only revealed what they imagine are the ten best stocks for traders to purchase proper now… and Walmart wasn’t one among them! That is proper — they suppose these 10 shares are even higher buys.

*Inventory Advisor returns as of 12/18/2023

Sean Williams has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

U.S. Money Supply Hasn’t Done This Since the Great Depression, and It Usually Signals a Big Move to Come in Stocks was initially revealed by The Motley Idiot

Now Local weather Change on the Newsmaac