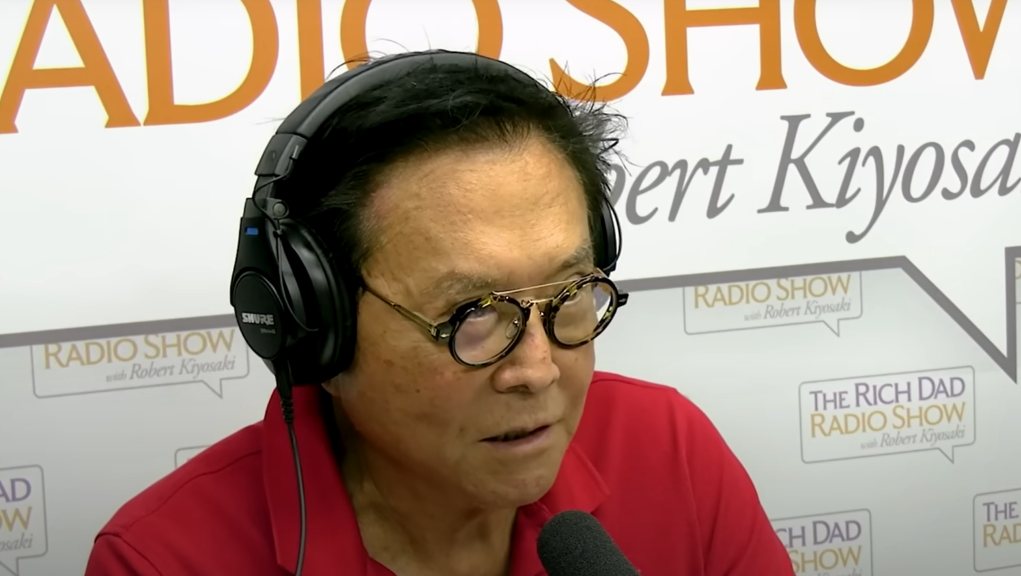

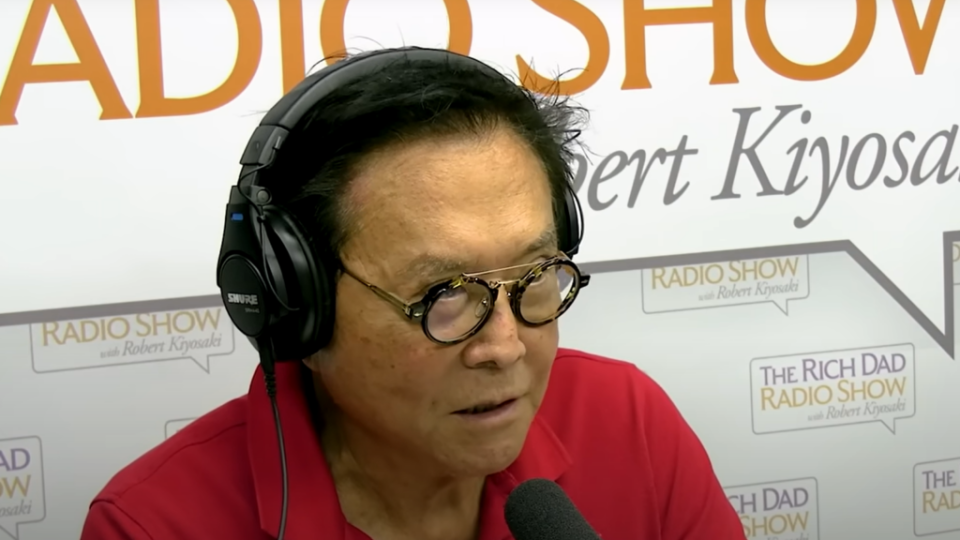

Robert Kiyosaki, a best-selling writer and seasoned investor, has a definite philosophy on debt and funding. In a Nov. 30 Instagram reel, Kiyosaki elaborated on his debt philosophy, highlighting a vital distinction between property and liabilities.

He stated many individuals use debt to purchase liabilities, whereas he makes use of debt to buy property. As an instance his strategy, Kiyosaki stated his luxurious autos, like a Ferrari and a Rolls Royce, are totally paid off, categorizing them as liabilities quite than property.

Within the reel, Kiyosaki additionally expressed skepticism towards saving money, referencing the U.S. greenback’s detachment from the gold commonplace in 1971 beneath President Richard Nixon. As an alternative of saving money, he saves gold and converts his earnings into silver and gold. This technique, in accordance with Kiyosaki, has led to an accumulation $1.2 billion in debt, an quantity he admits to. He says he’s in debt as a result of “if I’m going bust, the financial institution goes bust. Not my downside.”

Do not Miss:

His strategy includes utilizing debt strategically to reinforce wealth. Kiyosaki categorizes debt into good debt and dangerous debt, with good debt being that which helps construct wealth, corresponding to loans used for buying income-generating property like actual property, companies or investments. He advocates utilizing debt as leverage in investments, significantly in actual property, seeing it as an efficient strategy to experience market fluctuations and capitalize on alternatives.

Kiyosaki’s investment strategy is multifaceted. He’s recognized for his stance in opposition to fiat cash, labeling it in derogatory phrases and as an alternative advocating for funding in what he calls “actual property” like Bitcoin, silver, gold and Wagyu cattle. Bitcoin, particularly, is a favourite of his, perceived as a hedge in opposition to the deteriorating worth of the U.S. greenback. Kiyosaki views gold, one other key part of his portfolio, as extra steady and dependable than money, which he calls “trash” as a result of he simply does not “belief the frickin’ greenback.” He has expressed a willingness to extend his gold holdings even when costs drop considerably.

Silver, too, types a big a part of his funding technique. He views it as a long-term funding, significantly due to its rising rarity and comparatively cheaper price in comparison with gold. Actual property stays a cornerstone of his investments, valued for its twin advantages of rental revenue and capital appreciation. His funding in Wagyu cattle, a much less standard asset, displays his perception in diversifying his portfolio past conventional investments.

Kiyosaki’s strategy to debt and funding is rooted in a broader perspective on finance and wealth. He views cash as a type of debt or obligation, a instrument that can be utilized for buying property and producing wealth. His philosophy emphasizes schooling in finance, suggesting that individuals must be well-informed about monetary issues.

Whereas Kiyosaki’s strategies have been profitable for him, they arrive with dangers, as illustrated by his previous monetary troubles, together with submitting for bankruptcy in 2012 after a authorized dispute over royalties.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Recreation with the #1 “information & every thing else” buying and selling instrument: Benzinga Professional – Click here to start Your 14-Day Trial Now!

Get the newest inventory evaluation from Benzinga?

This text ‘Rich Dad, Poor Dad’s’ Robert Kiyosaki Says He’s $1.2 Billion In Debt Because ‘If I Go Bust, The Bank Goes Bust. Not My Problem’ initially appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Now Local weather Change on the Newsmaac