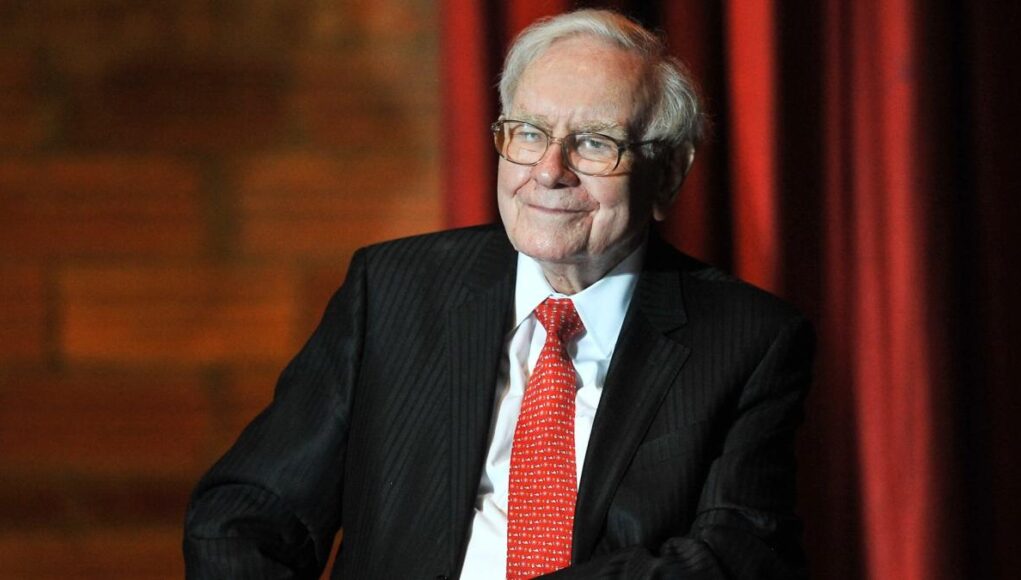

Warren Buffett is a giant identify within the investing world. With a web price of $114.2 billion, folks hear when he talks. From picking small companies to not sweating it when your stock drops, here’s Buffett’s advice for investing $10,000 if you want to get rich.

Be taught: 11 Uncommon Investments That Can Actually Make You a Lot of Money

Discover Out: 3 Things You Must Do When Your Savings Reach $50,000

Get Began Early

Before everything, Buffett recommends getting began early on the subject of investing to reap the benefits of the ability of compound curiosity. He describes the ability of compound curiosity as constructing slightly snowball and rolling it down a really lengthy hill. Because the snowball rolls down the hill, it collects increasingly snow till it turns into an enormous snowball.

At an annual shareholders’ assembly, when somebody requested him how they may make billions of {dollars}, Buffett mentioned, “The trick is to have a really lengthy hill, which implies both beginning very younger or residing… to be very outdated.”

Be taught: How Much Is a Gold Bar Worth?

Spend money on Small Corporations

Buffett recommends investing in small firms. Massive buyers — like Buffett — and funds have a tendency to put give attention to bigger firms, which implies small enterprise shares can have much less competitors, permitting somebody with $10,000 to search out some hidden gems.

Nonetheless, Buffett mentioned the one option to multiply your cash is to purchase into good companies by shopping for items of them — aka shares — at enticing costs.

Buffett mentioned if he was simply getting out of college and had $10,000 to speculate, he’d start by firms which have names that begin with “A” and proceed down the checklist, specializing in smaller firms to search out those he wished to put money into.

Don’t Fear About Your Inventory Going Down

“Should you’re going to do dumb issues as a result of your inventory goes down, then you definately shouldn’t personal inventory in any respect,” mentioned Buffett in an interview with CNBC. Dumb issues, he clarified, are promoting your inventory simply because the value goes down.

Buffett mentioned that it’s inevitable that your inventory will go down someday, so why fear about it. “The purpose is to purchase one thing you want, at a value you want, after which maintain it for 20 years,” he mentioned.

Buffett mentioned you shouldn’t have a look at your shares each day. “Should you purchased a farm or an residence home, you wouldn’t get a quote on it each day or each week or each month,” he mentioned. “So it’s a horrible mistake to think about shares as one thing that bob up and down and that you must take note of these bobs up and down.”

Extra Knowledgeable Recommendation for Investing $10,000 To Get Wealthy

Robert R. Johnson, Ph.D., CFA, CAIA, professor of finance at Heider School of Enterprise, Creighton College, mentioned, “One of the best funding technique for many buyers is to Preserve it Easy, Silly (KISS). Folks ought to put money into a low-fee, diversified fairness index fund and proceed to speculate constantly whether or not the market is up, down or sideways.

“Greenback-cost averaging into an index mutual fund or ETF is a terrific lifelong technique. Greenback-cost averaging is an easy approach that entails investing a set sum of money in the identical fund or inventory at common intervals over an extended time period. For the overwhelming majority of buyers, the KISS mantra — preserve it easy, silly — ought to information their funding philosophy.”

Relating to Buffett, Johnson mentioned, “Warren Buffett has created an empire by investing in boring, staid enterprises like See’s Candies, Dairy Queen and Nebraska Furnishings Mart. These is probably not horny firms, however they carry out effectively…

“Consistency and persistence are the virtues related to accumulating wealth over the long term. Jeff Bezos as soon as requested Warren Buffett: ‘You’re the second richest man on the planet and but you may have the only funding thesis. How come others didn’t observe this?’ To which Warren Buffett responded: ‘As a result of nobody desires to get wealthy slowly.’ What Buffett is referring to right here is his philosophy of investing in good firms and staying invested for the long-run, letting compounding work its magic.”

Extra From GOBankingRates

This text initially appeared on GOBankingRates.com: Warren Buffett Reveals How To Invest $10,000 If You Want To Get Rich

Now Local weather Change on the Newsmaac